Generate disposable income calculations based on data extracted from CRIB and data added to the application

View MoreIn addition to the above, eDGEVANTAGE provides standard benefits of having a workflow with integrated document management and decision support functionality, which are:

Visibility of the entire process

Ability to locate a customer request easily using the Scoreboard

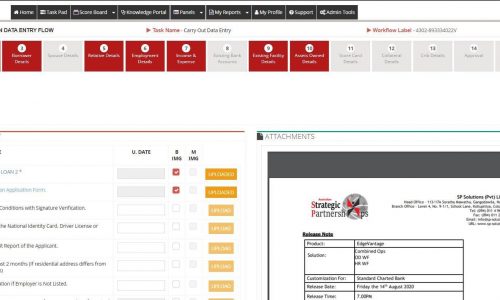

Ability to manage all mandatory and optional documents

Ability to manage hard copies, including boxing functions, lodgement and retrieval of boxes with a archival service provider

Ability to generate email reminders and alerts to internal staff

Ability to automate customer communication by generating automated messages to customers, alerting them to progress

Interdepartmental handshakes are managed ensuring the handover from team to team is smooth and efficient

Measure turn-around-times, including a breakdown of queue times and task performance times

Provide reporting of TAT against agreed SLA’s

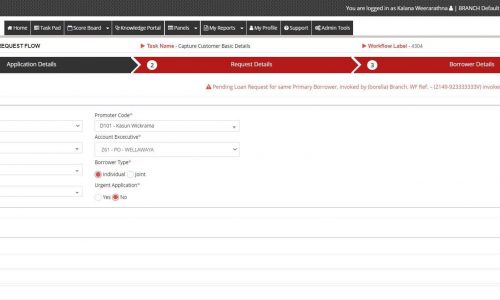

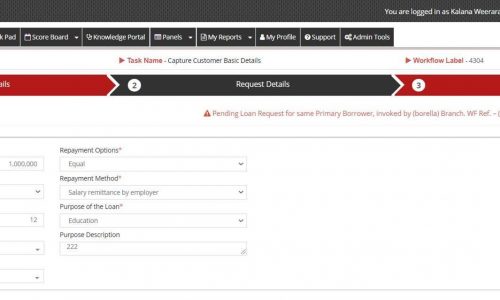

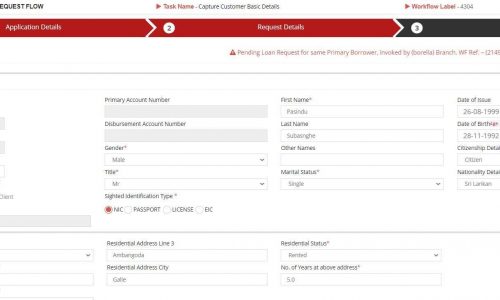

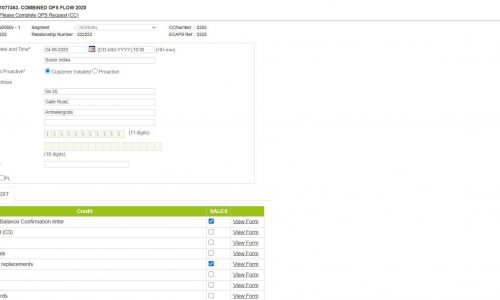

Capture the customer request

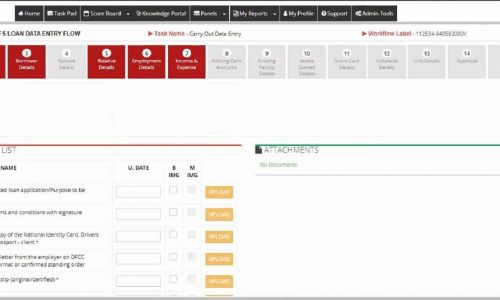

Customer requests can be captured using a standard hard copy document that is scanned and the data then entered or keyed into the system. Alternately, eDGEVANTAGE allows the data to be entered into an e-form by a customer, then printed to meet the hard copy requirement. This e-form technology allows organisations to avoid data entry and validate the accuracy of data that the customer has entered themselves. Other variations of this function are that end customers can complete the electronic mandate via a mobile device, while also attaching all supporting documents using an intelligent panel, which has the smarts to ensure all mandatory documents are fulfilled in order to process a request.

Image based processing

The system facilitates image-based processing, where the underwriting decision is based on an image of the customer mandate and all support documents. eDGEVANTAGE allows the business to define the documents required for different products managed within the same process, as well as mandatory and optional document requirements. The system will not allow a facility to be processed until all mandatory documents are received. There is a huge efficiency gain and a cost advantage, from not moving the physical file across the process from branches, to the central processing unit. Ideally the hard copy remains at the point branch until the facility is granted or rejected, and then archived.

Internal checklists and Routing of an application

The system allows all internal checklists to be automated and uses some of the data entered by branches, verification teams, document checkers, and approvers to route the application to the correct team and decision making authority. This allows staff to focus on specific value additions and decisions that cannot be automated or systemised.

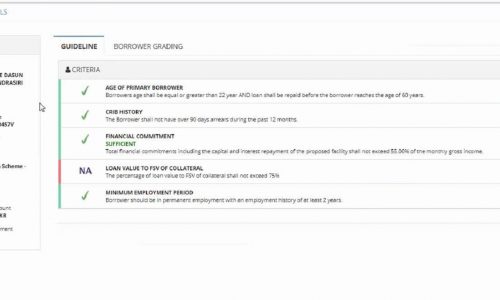

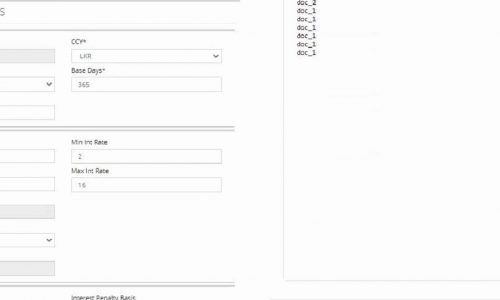

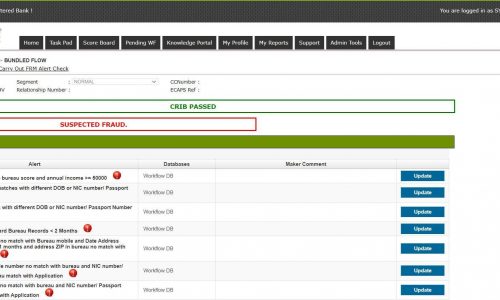

Customer Credit Worthiness

In Sri Lanka, a customers CRIB report provides a detailed picture of the persons credit worthiness. eDGEVANTAGE has the ability to grade a CRIB file based on the institutions credit policy for different products, which can be loaded into the system. The platform then grades the report based on the policy defined. eDGEVANTAGE allows each and every field within the CRIB file to be used to construct the credit policy. If the CRIB files fail when compared to policy the platform flags the criteria which caused the failure so that underwriters can verify the data when looking at the CRIB, which can also be viewed within the platform.

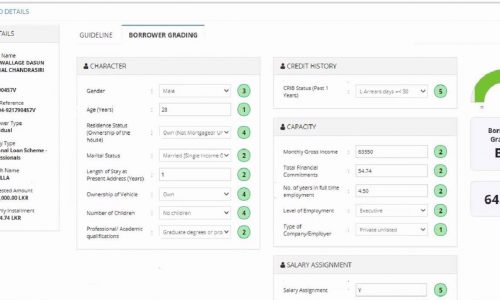

Automate Score Cards

Many items or questions within a lending score card are based on the clients existing commitments and facilities already obtained from said institution and other institutions. Therefore the system can be setup to check and export all facilities and outstanding values, as well as repayment history of the customer within a predefined period, and use the data to automate the scorecard. Other questions in the score, including questions regarding the customers income, can be automated based on the data entered into the system as part of the application.

DSC Calculations

All lending institutes generate and verify that a client has a minimum score in terms of disposable income, based on the income earned and existing commitments on CRIB. This disposable income calculation has minor variations from institution to institution. Therefore, we are able to tailor the function and automate the DSC calculation to further expedite the process for the underwriting team.

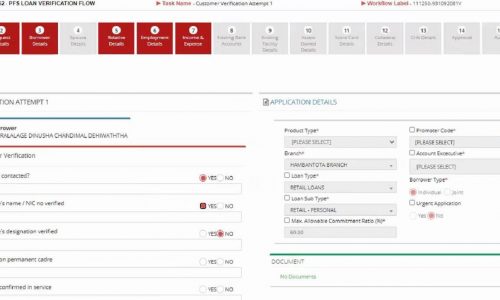

Verification

In Sri Lanka, most institutions carry out call verification before a facility is granted, usually certifying the customers’ residence, employer, and relatives. This process is mapped within the workflow, and 3 or more attempts can be allowed, with details captured during the verification process documented and made available during decision making. If verification fails the eDGEVANTAGE platform allows the institution to make a GO or NO-GO decision for failed verifications.

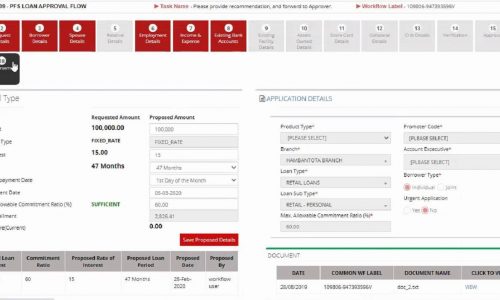

Approvals

The system maintains a comprehensive DA module, which allows the application to be routed for approval to DA holders who carry the required delegated authority, based on multiple factors including value of the facility, product based segmentation, and other customer profile based segmentation. However, approvers do have the ability to route to specific approvers when they wish to have a covering approval before system approval is granted.

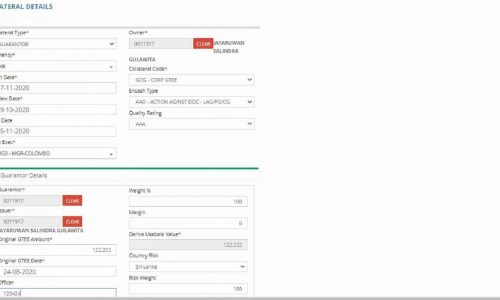

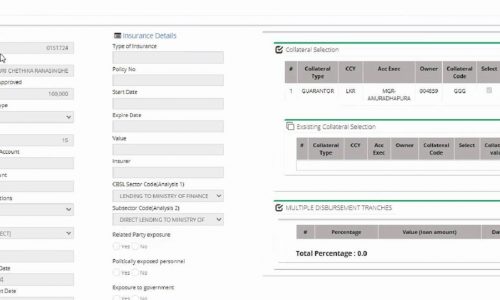

Collateral

If collateral is used to secure a facility the eDGEVANTAGE platform allows collateral to be registered with market value, forced sale value and percentage assigned to each facility. Collateral can be include deposits, assets, and personal guarantees

System generated documents

The system is able to create documents templates which the customer is required to sign, based on the product and the agreed terms and conditions. These documents are generated in PDF format, ensuring the document cannot be tampered and no system added clauses are removed or amended. The duly signed documents can then be digitised and added back into the system.

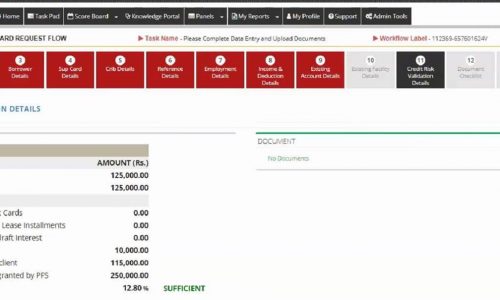

Disbursement Tabs

Funds are generally disbursed on the core platform. However the eDGEVANTAGE system generates a disbursement tab that the Credit Admin team can use and verify before making a disbursement. This tab can be customised from customer to customer, and will contain data including an automated disbursement prompt for multiple tranches as and when these milestones are realised.

Fraud Checks

eDGEVANTAGE has the ability to match data entered into the application with data extracted from CRIB and validate this data with other external databases to identify and flag potential fraudulent applications.The system can also use data from multiple sources to identify patterns and a common data set in applications received over a period or time to flag potential fraudulent claims. These flagged applications can be sent to a special investigation team and cleared or terminated.