CRIB Solution

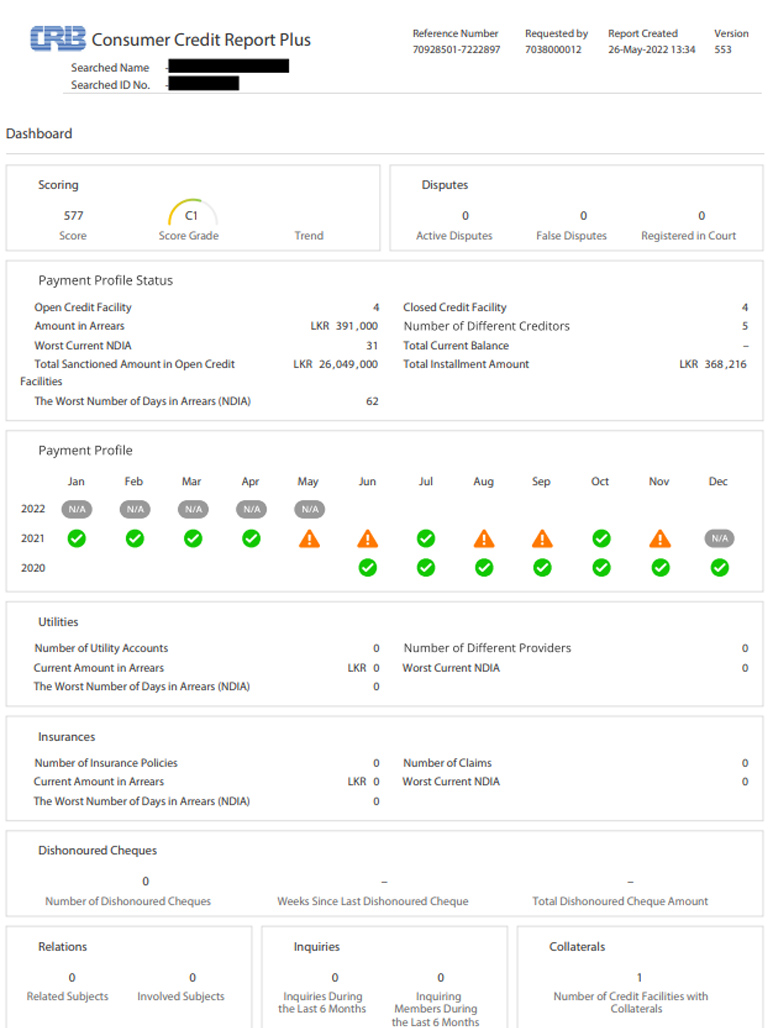

What is the CRIB Report?

CRIB Formats

The existing CRIB platform provides the report in a MHT file format. eDGEVANTAGE is the only known system which captures a CRIB report, extracts and stores the data in a database, and enables the institution to use that data to auto-calculate Score Cards and the DSC.

The new CRIB platform maintains the same data in a slightly different format.

The report can be extracted as a PDF but does also have the functionality to be extracted via web services as an XML object.

The new platform also supports bulk CRIB reports in a single call, which is required for limit enhancements and promotions that may be extended towards a Bank’s Card/Loan Customer Portfolio.

The New CRIB Pull Workflow

A product of eDGEVANTAGE, this workflow enables a Bank or Financial Institution to configure a BOT, which can then login and download the CRIB search pane and CRIB report in PDF format or set up an integration to extract data via web services.

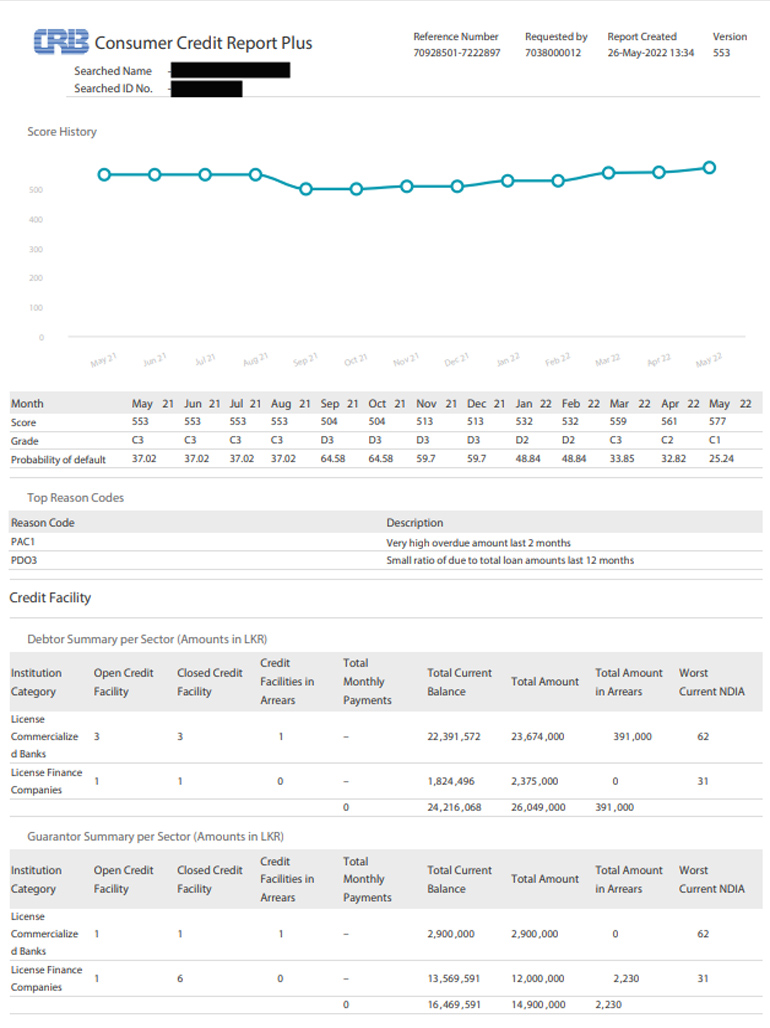

It uses multiple extraction techniques to distill the data from the PDF/XML object and store it in a database, allowing for support for the generation of score cards, CRIB Report Grading, and DSC calculations.

Bulk CRIB extraction is a prominent feature of the workflow, allowing all data to be extracted in XML format and provided to the institution for further use.

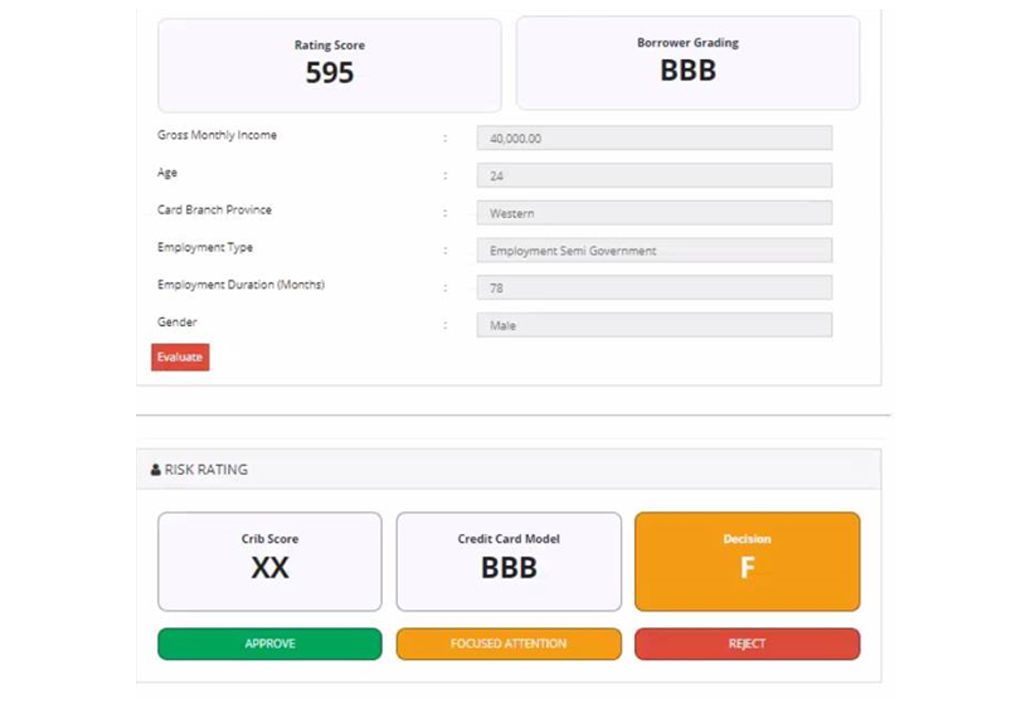

The workflow also has functionality to grade CRIB reports, generate Score Cards, run Fraud Checks, and ensure the underwriting process makes the best use of the technology at hand.

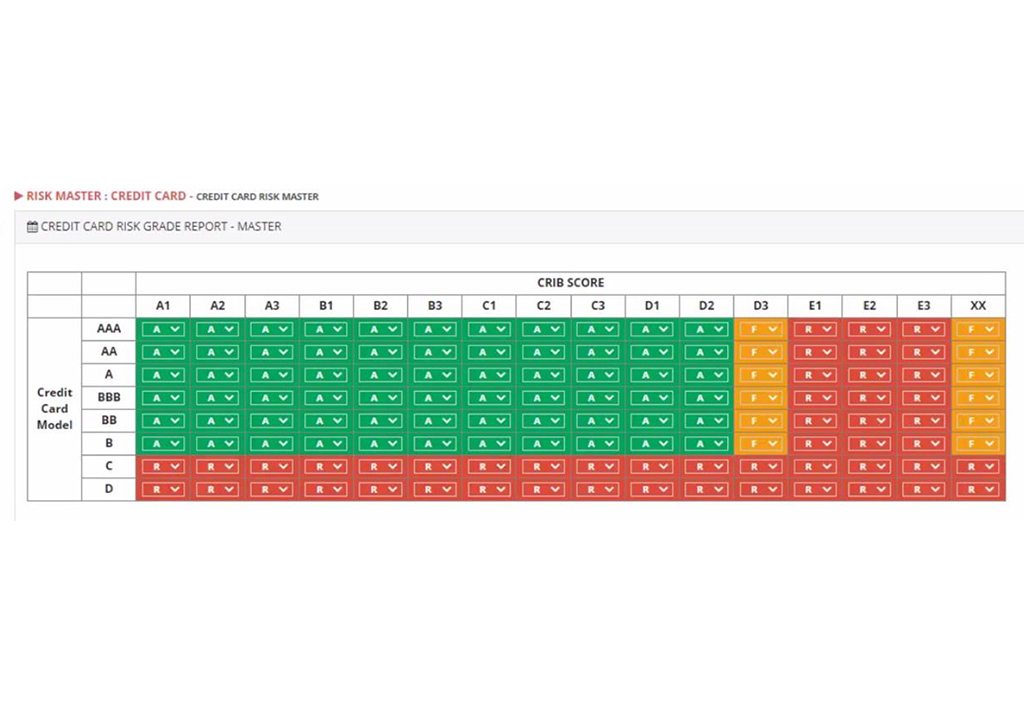

Rule Setting Tool

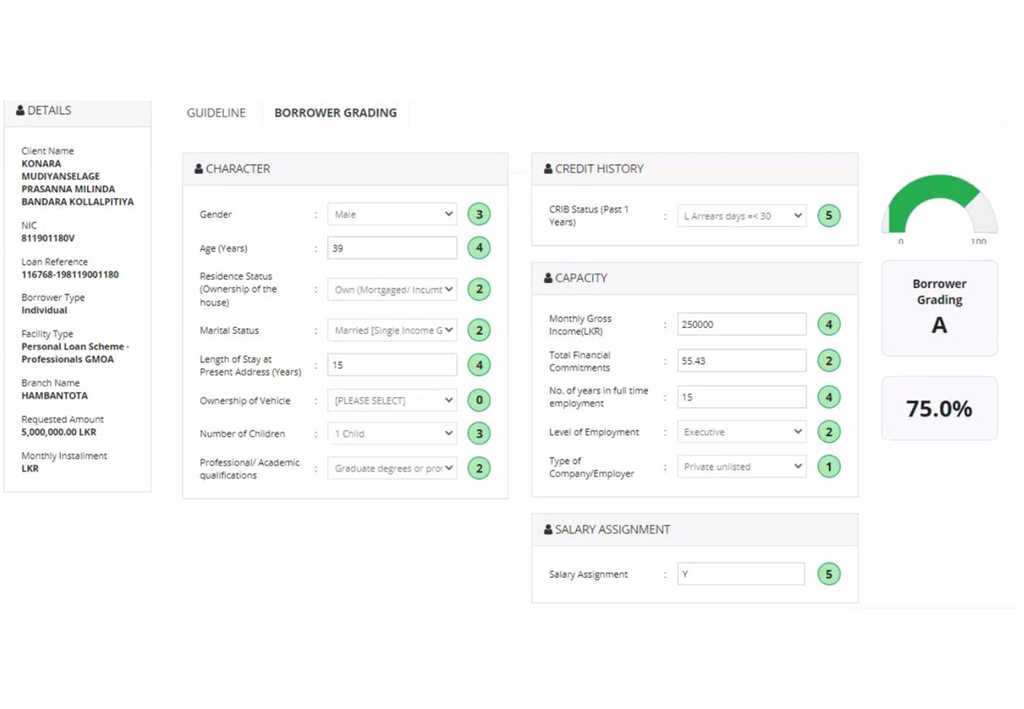

The Rule Setting Tool featured in the eDGEVANTAGE Workflow allows the User to select criteria that will then automatically rank CRIB data files as required by the Bank or Institution.

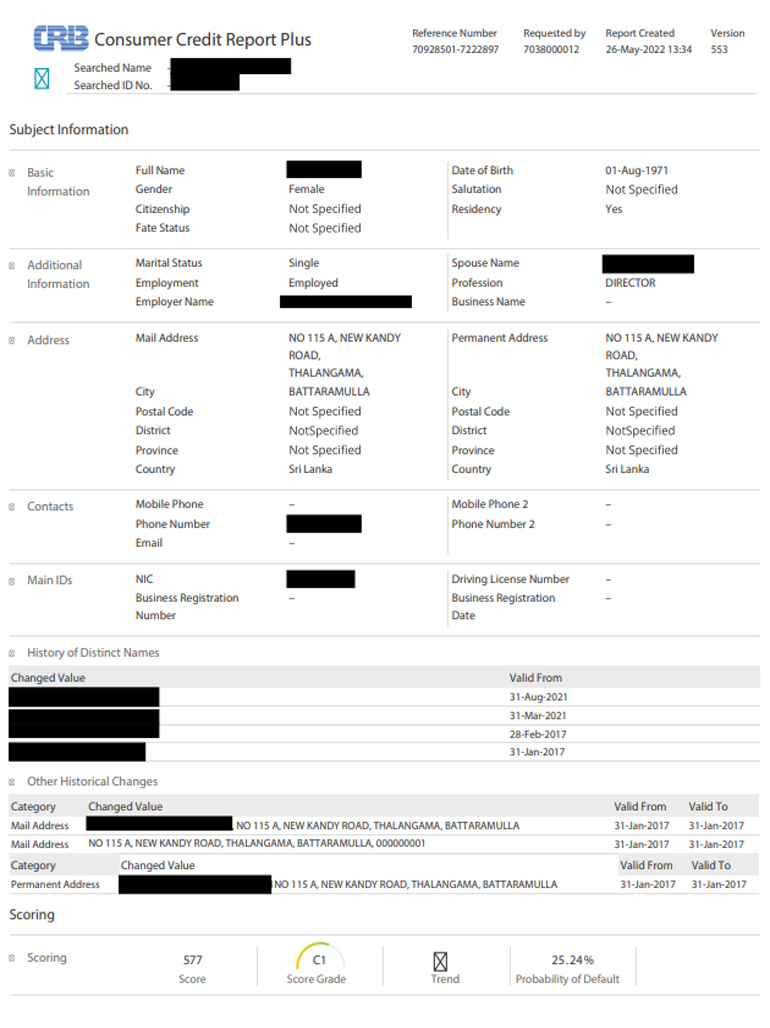

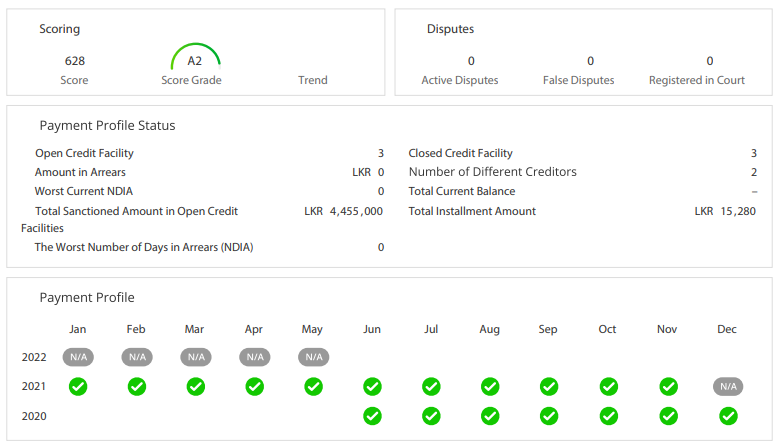

The CRIB Report compiles an Individual’s credit and financial history, with an assessment by the Bureau (indicated by a letter grade) as to the Individual’s credit worthiness.

However, many Banks and Financial Institutions allocate significant resources into measuring an applicant’s credit reliability by the institution’s own metrics. A Bank may review anywhere from a thousand to five thousand requests per month for credit or leases, and manual assessment of each application is both time consuming and subject to error.

The Rule Setting Tool allows the User to define “Rules” by which an application may be graded as “Good” or “Bad”, including the ability to filter applications by gender, age, the value of liable credit repayment, and so on.

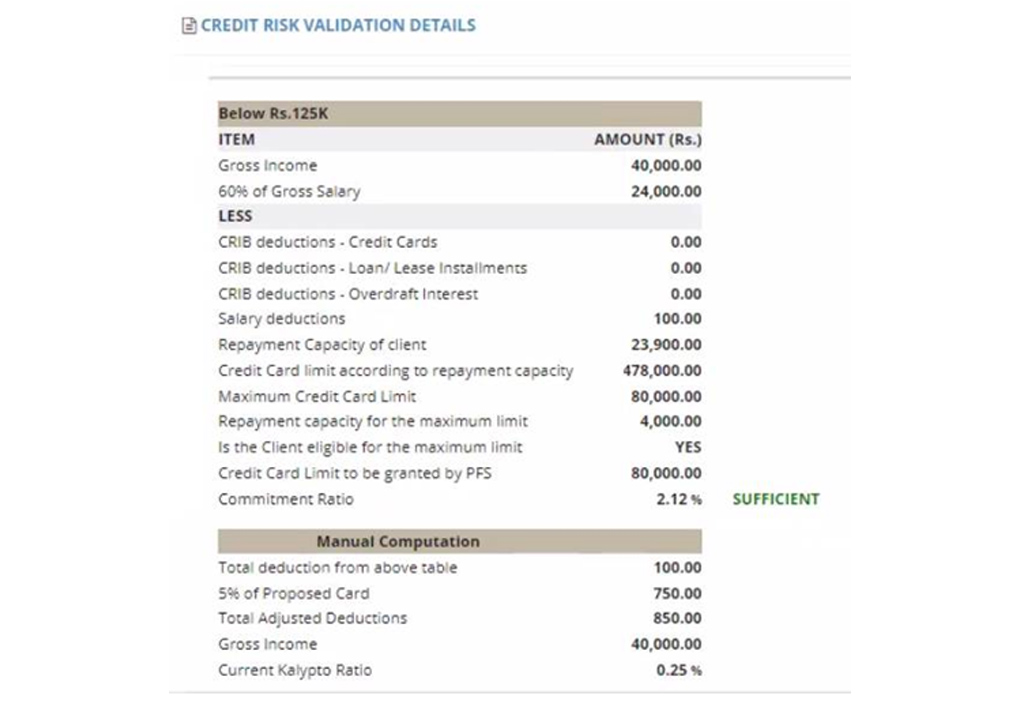

The Tool has the smarts to ignore criteria where the value is insignificant and highlight those aspects of the application, as well as perform calculations to assess the limits that should be imposed on credit card leases or loans.

This feature allows work that would previously require hours of the time of a dedicated resource to be completed in seconds.