Workflows, Document Management and Decision Support for Banks!

Banks have been a key customer segment for SP and eDGEVANTAGE over the last 10 years. Over the last 3 years we have grown from servicing One Bank in Sri Lanka to servicing Four.

This case study allows us to show case the different Focuses and the Thrust of each solution provided to the Banks we work with. This is an integral part of the value add we deliver to our clients through eDGEVANTAGE.

The Banking Industry in Sri Lanka

The Banking Industry in Sri Lanka is a mature industry, with most Commercial Banks offering the same range of products. There is fierce competition between Commercial Banks to differentiate themselves through service delivery and customer experience.

Therefore Banks need tools that help them monitor the service they deliver to customers, automate to reduce work and increase efficiency and turn-around-times. This is where eDGEVANTAGE fits in.

| Clients | Commercial Banks in Sri Lanka |

|---|---|

| Solution Designers | Jehan Bastians

Dinesh Wijesinghe Shayen Yatagama |

“TECHNOLOGY, LIKE ART, IS A SOARING EXERCISE OF THE HUMAN IMAGINATION”

~ DANIEL BELL ~

4 Banks - 4 Different Requirements

The flexibility of the eDGEVANTAGE solution can be best articulated based on the different solutions provided to the four Commercial Banks we currently engage within Sri Lanka

Standard Chartered Bank – The requirement was to manage customer requests received at the bank and improve the responsiveness of the bank to customer requests by improving Turn-Around times and to improve visibility of the requests and see where they were pending, and how long each team took in processing these requests. For SCB in designing their workflows, attention was given in automation and managing inter-departmental handshakes.

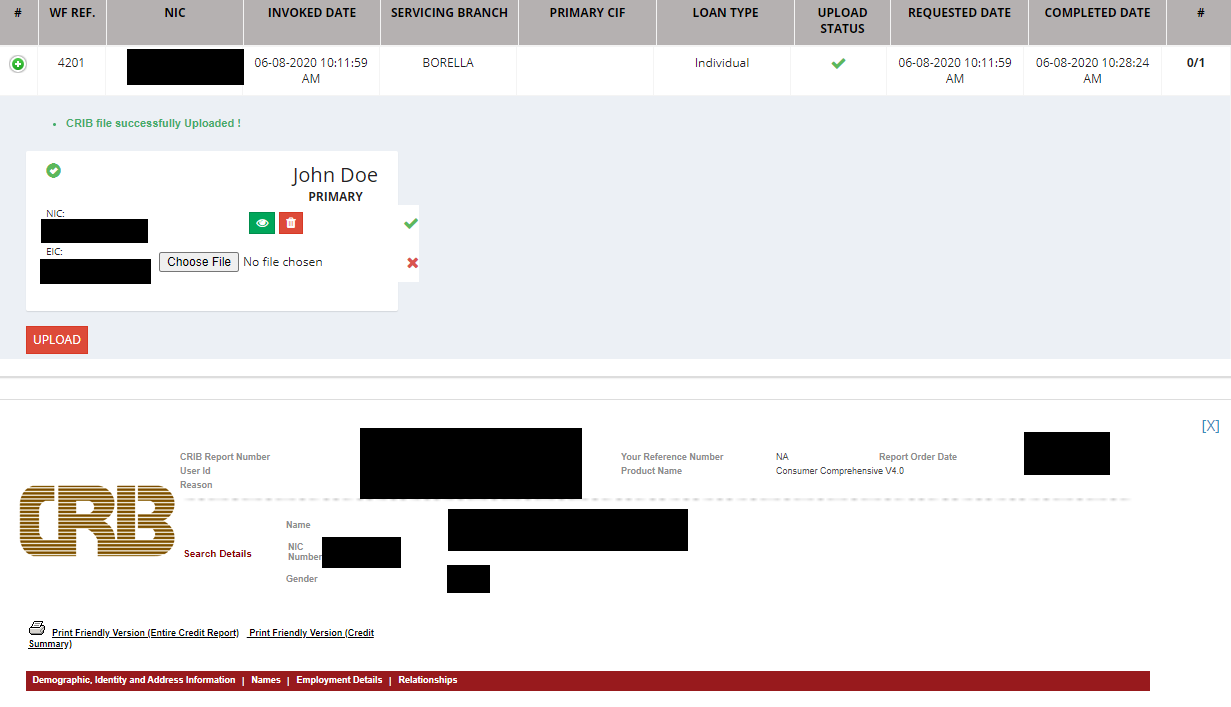

We now manage over 50 workflows for SCB including the Accounts, Cards and Loans onboarding, and Underwriting workflows. One of the key features of the system we have delivered for SCB is the automation of checks and balances between the application, CRIB file and external 3rd party, fraud databases, to ensure that SCB can identify potentially fraudulent applications with the support of the checks and balances on the system.

The system automates the reading and grading of the CRIB files based on the credit policy for the different products, enabling the bank to automate the grading and classification of CRIB files which is a time consuming manual task assigned to underwriters.

Union Bank – The Bank has over 60 branches and since the re-launch of the bank and the brand in 2015, there has been a move towards increasing the scope of operations. This required the Bank to manage the movement of hard copies between the branches and the Central Ops teams. Together with the need to improve the operational efficiency of all customer requests received through the branch network and call center.

At Union bank eDGEVANTAGE is used to manage customer requests which are hard copy based and to convert the process to image-based processing, thus improving TAT. The system is also used to manage facilities and ensure internal complaints about systems, hardware, and processes as well as service issues are raised, addressed, and resolved expeditiously.

The platform is also used to manage the outsourced filing of all correspondence, with two service providers, who pick up boxes of documents and archive the same. The system is used to recall boxes when there is a need for hard copies for legal and regulatory requirements.

eDGEVANTAGE is also used to manage board-level review for outsources business projects and operations and to manage the processing of customer service requests, new accounts, outward remittances, underwriting of credit cards, and well as a host of account, card, and loan maintenance activities.

Seylan Bank – eDGEVANTAGE is used to manage their cards and loans workflows integrating the approved cards and loans to their core system. The data required to review and underwrite the cards and loans are taken from the core banking platform, the CRIB file of the customer, and through data entry. The workflow is routed based on the internal checklists and business forms filled by the users within the workflow.

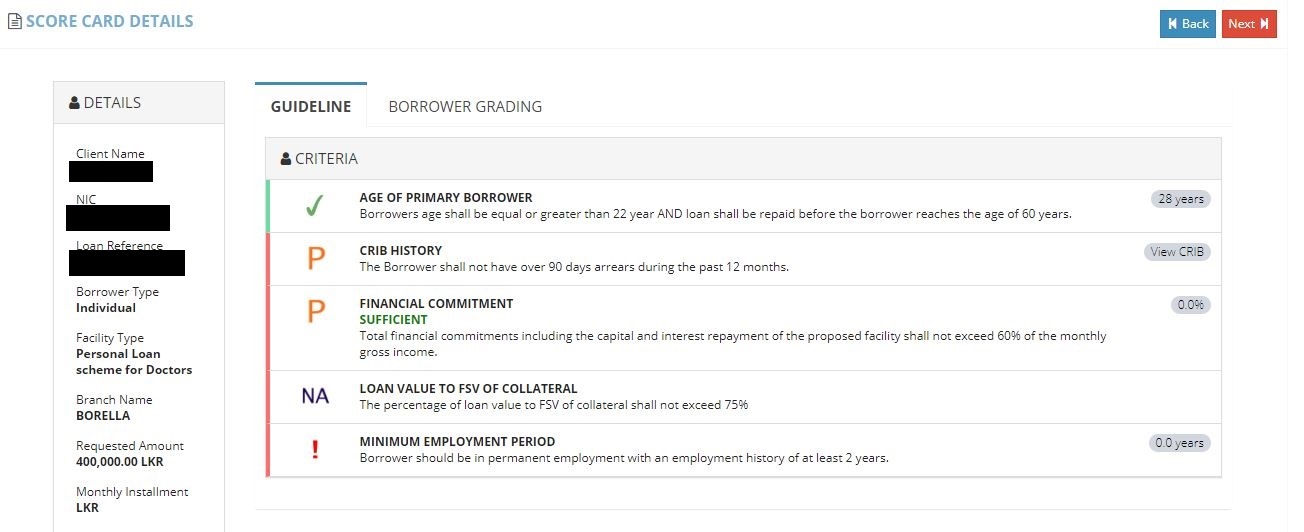

The system includes an integration to obtain the basic details of the customer using the NIC (for existing customers). Thereafter the system generates both a scorecard and the DSCR calculation for underwriting purposes. The routing of the workflow is based on the checklist, and the routing is automated.

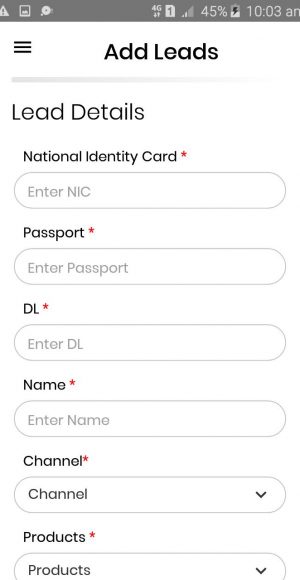

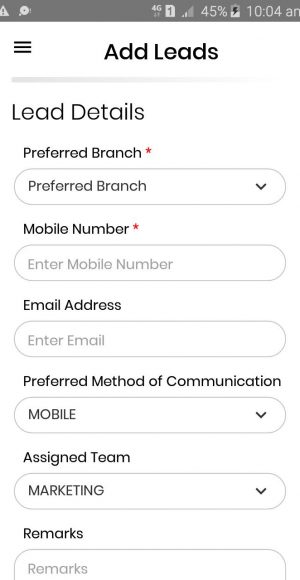

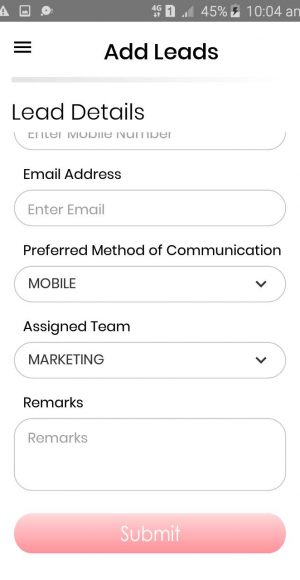

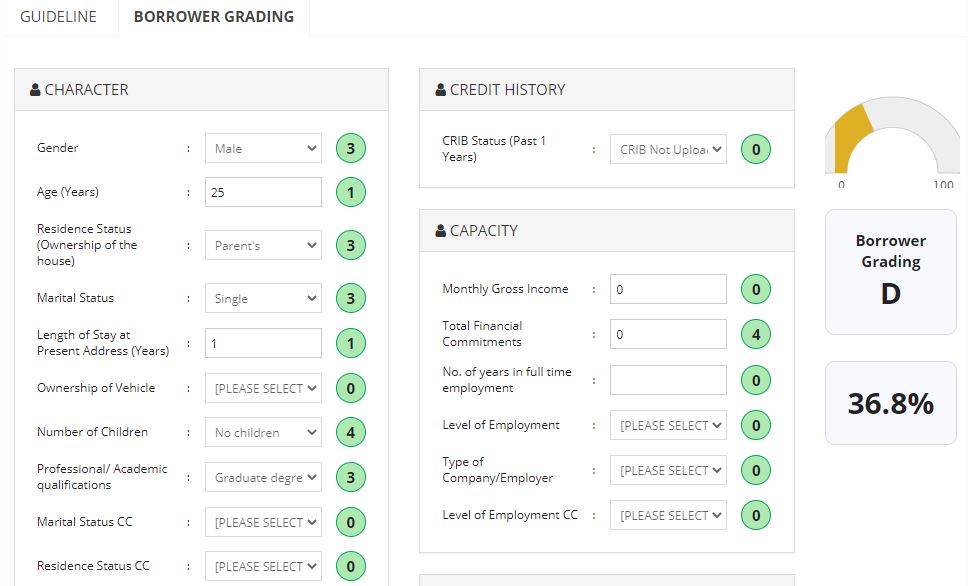

For Seylan, we have also deployed both a Lead Management System and a Complaint Management System, based on eDGEVANTAGE. The LMS and the CMS run on an Angular JavaScript front-end, with graphical dashboards. The platform is designed to run on mobile apps for lead creation as well as for customers to confirm that complaints have been resolved while updating a satisfaction score for all interactions.

We have just moved a new cheque book processing workflow to production at Seylan Bank. The solutions collates all-new cheque book requests received from multiple channels and present the same to the branch at which the account is maintained. The branch fills in some basic information and submits the request to a central panel. The branch manager is required to update and approve the request if there are certain conditions met or not met as the case may be. These validations are based on data obtained via integrations to the core. The system generates and passes the cheque printing orders to the two vendors based on the account index. The system generates cheque numbers ensuring there are no duplicate cheque numbers generated within a branch. The system maintains number sequences and special cheque orders. The cheque fees and the mailing charges as well as any other applicable charges are passed to the core system. Once the cheques are printed the system facilitates mailing to the customer and collection by the customer. Detailed panels allow all the banks to ensure all requests received are processed and delivered on time.

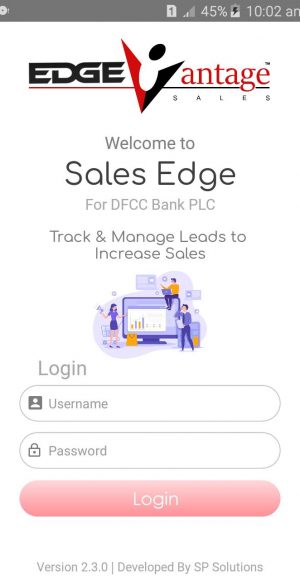

DFCC Bank – The requirement was to deliver a front-end platform that would help the Bank track and manage customer requests from its 100+ Branch Network and to provide visibility and control to the Central Processing Teams and to have the same linked closely with its Core platform. We manage their Account Opening workflow and create the account on the core platform. We also support a digitization initiative at DFCC with an archival workflow, where already opened account mandates are scanned and digitized, while managing the boxing and archival function. eDGEVANTAGE also handles the service request workflow, which facilitates all service requests received from customers for an account, cards, and loans as well other value-added services such as e-statements, i-banking, and DFCC SMART Wallet.

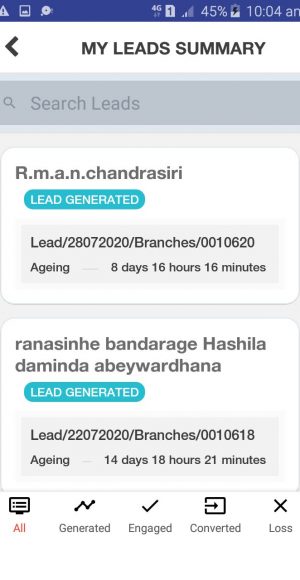

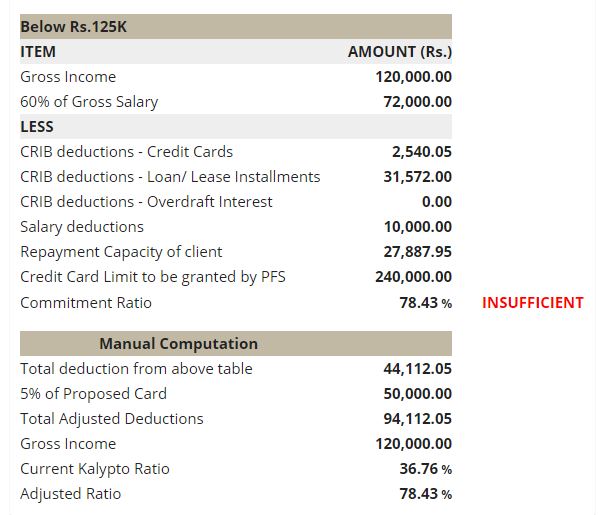

The PFS workflow is an integrated end to end Loan Underwriting platform for personal loans. The system is used to extract customer details for existing clients, and then process the loan application using a concept of sub-workflows or Microflows. This allows the bank to multi-task and handle different aspects of the system parallelly thus improving the turnaround time. The system generates the CRIB grading and support data from the scorecard and the DSCR by extracting data from the CRIB file uploaded. All collateral and loans are created on the system once approved on the workflow with a comprehensive DA system that uses multi-factor modeling to escalate the approval to the relevant DA holder.

The Credit card workflow is similar and handles the entire process end-to-end with CRIB Grading, Score Cards, and DSCR calculation automated using data from the core platform (for existing clients) CRIB and data from the signed mandate. This workflow also includes a risk rating integration to the banks’ risk rating software Kalypto with the system using data already entered and extracted to respond to a dynamic questionnaire from Kalypto and to receive and display the risk rating for the facility. Once approved the card is created on the bank’s Card Management System by EPIC.

The LMS and CMS have also been deployed at DFCC to help them manage the efficiency of converting leads into sales and also to manage customer complaints better, thus improving customer responsiveness and customer retention.

SP has just been commissioned to integrate the workflow to their new Core platform Temenos with integrations not only to extract information from core systems but also to write loans, cards, and other facilities to the core together with collateral and other master data.

It will be a game changer for Seylan Bank

The ability to see customer applications, the ability to track the progress of applications within our process, and the enhanced visibility for managers to view these on graphical dashboards

Rukshan Ediriweera

Core Functions Delivered

The eDGEVANTAGE platform has 3 core functions

Workflows – which is the key function for which the platform is used by the Financial services companies. To automate processes that run across multiple departments, managing interdepartmental handshakes and automating many of the checks and balances that are usually handled by underwriters and department checkers. The platform also included a track & trace utility which we call a scoreboard which shows the location of every workflow and provides the TAT for each workflow instance.

Workflows – which is the key function for which the platform is used by the Financial services companies. To automate processes that run across multiple departments, managing interdepartmental handshakes and automating many of the checks and balances that are usually handled by underwriters and department checkers. The platform also included a track & trace utility which we call a scoreboard which shows the location of every workflow and provides the TAT for each workflow instance.

Document Management – The system enables the processing of customer requests using an image in place if moving the hard copy document across the process. The system also supports a full document management functions from managing document access and permissions. Comparing and reconciling images with the hard copies, while also handling the archival retrieval of the hard copies.

Document Management – The system enables the processing of customer requests using an image in place if moving the hard copy document across the process. The system also supports a full document management functions from managing document access and permissions. Comparing and reconciling images with the hard copies, while also handling the archival retrieval of the hard copies.

Decision Support –whereas most typical workflows are simple routing of documents, the workflows provided via Edgevantage are complex interdependent processes, which are routed automatically using the data in the forms. The forms contain data entry fields and checklists which are used to build routing logic to drive the workflows. The forms are also used to present data in a meaningful format so that decision-makers can make informed decisions.

Decision Support –whereas most typical workflows are simple routing of documents, the workflows provided via Edgevantage are complex interdependent processes, which are routed automatically using the data in the forms. The forms contain data entry fields and checklists which are used to build routing logic to drive the workflows. The forms are also used to present data in a meaningful format so that decision-makers can make informed decisions.

For example, we create automated DSC calculations and Score Cards for lending products using data entered by the user and extracted from the user’s CRIB file.

Other Newer Functions

Mobile Apps – The system is now compatible with mobile devices and therefore certain approval functions can be used on mobile apps. There are other specific functions that can also be ported on a specifically designed mobile app.

CRIB BOT – eDGEVANTAGE has a built-in CRIB BOT which allows any and all data in an uploaded CRIB file to be extracted and stored in the database. The system also displays the CRIB file for visual inspection, while also grading the CRIB file based on the bank’s credit policy.

Dashboards – The platform now runs with dashboards, that are configured to provide real-time data on the processes.

Alerts – The eDGEVANTAGE platform can be configured to deliver email and SMS alerts to customers and bank employees alike.

Block Chain Ready

The eDGEVANTAGE workflow is now block chain ready and therefore can be used to connect to the proposed blockchain-based shared KYC platform. The details have still be shared by CBSL, but any bank with the platform will have the additional benefits of being ready to manage KYC while opening New Accounts, accepting Service Requests, or even Underwriting cards, loan overdrafts, and other Business and Trade Facilities.

Results Delivered & Value Added

Across the Banking Sector – we have delivered and continue to deliver value using the platform.

Visibility Enhancement – The ability to see all requests received, where they are in the process, how long it takes across the process, how is the TAT distributed between the different departments and stakeholders. This is achieved using the Task Pad Filters, Graphic Dashboards, TAT reports, EOD reports, and Rework Reports.

Automation of Mundane tasks – We have built and deployed a few AI components to crunch data and automate tasks that would normally be done by Underwriters and Verification: Matching information extracted from CRIB reports with data entered into various interfaces for Verification and Underwriters and the automatic grading of the CRIB reports based on the banks defined credit policy

Track & Trace – the ability to search for and retrieve data on any process on stance and view all data entered, checklists completed, and documents attached. This is delivered via the Scoreboard

Search for and retrieve documents based on Permissions – The ability to search for and view documents based on a file structure, set index criteria, and permissions defined for each Workflow. This is further enhanced by the ability to manage the boxing, archive, retrieval, and re-lodgment of hard copy documents.

Wide Functional Distribution

Wide Functional Distribution